As countries around the world announce zero emissions goals for the near future, the electric vehicle charging infrastructure market is expected to grow exponentially. In 2020, the market size was valued at $15 billion, a number that analysts predict will increase at a rate of 33.4% year-over-year until 2028.

“The industry is literally on fire, and I truly believe that we’ve positioned Blink to take advantage of that,” Brendan Jones, chief operating officer at Blink Charging told EVPulse. “I think our investors have seen that, too.”

Blink’s stock price recently exploded with a 3,000% increase over the past eight months. That’s more than Tesla’s stock, which increased just under 1,000% over the same time period. One possible reason? Investors are crazy for green companies.

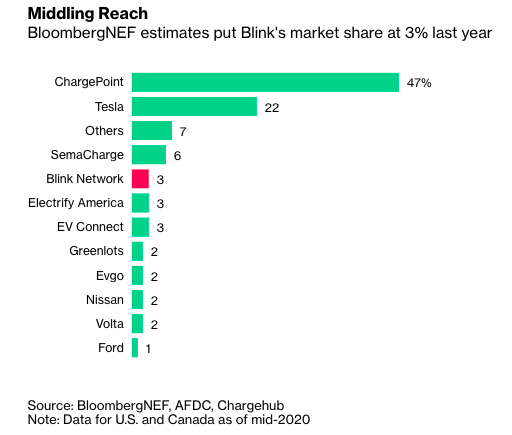

Some skeptics say Blink’s meteoric stock rise is out of sync with its value as a company. Blink hasn’t posted an annual profit in its 11-year history, and it’s had a high management turnover rate in recent years. Once a major player in the charging game, Blink has lost much of its market share. Last year, its major competition, ChargePoint, controlled 47% of the market share, with Tesla trailing behind at 22%, according to BloombergNEF estimates, which also put Blink’s market share at 3%.

Jones isn’t worried, though. Since he’s come on as COO at the end of March last year, the company and its business model has continued to restructure in a way that he hopes will keep Blink in the game.

“What sets us apart is that there are other companies out there that just sell the equipment and make money off the networking fees and maintenance,” said Jones. “We’re going to make money off the utilization of those chargers for the foreseeable future.”

Over the past year and a half, Blink’s new business model has branched out into three tiers.

Blink does sell its chargers, and has seen a great deal of success over the past 18 months since the launch of its Blink IQ 200 19.2 kWh charger. Jones said sales have been up over 100% month-over-month, and in January, sales increased by around 350% over the previous month, a trend he expects to continue this month.

The second tier is the company’s hybrid model, where Blink owns the charging equipment, pays for part of the installation, provides maintenance, and splits the utilization revenue with the site host. This model allows Blink to build long-term relationships with site hosts who will likely be return customers when it’s time to reinstall with newer units. Blink’s third tier is its owner-operator model, wherein it sets up charging stations and collects revenue off of each charge.

Chargers in operation now must reach 10%-15% utilization to break even, according to Bloomberg. Jones declined to share Blink’s charging utilization rates, but historically no company has made money on charging. That doesn’t mean it’s not possible.

Blink might just be encountering the perfect storm for success. The recent market interest in the industry has helped the charging company raise $232.1 million through a share offering in January, a capital investment which might help Blink come out of its previous anemic growth rate into a healthy growth.

The success of any charging company is largely dependent on the sale of EVs, and according to Bloomberg New Energy Finance, EV demand is expected to rise globally as batteries improve, new markets open, and price points and range reach parity with internal combustion engine vehicles. The study predicts EVs will hit 10% of global passenger vehicle sales by 2025, 28% in 2030, and 58% in 2040.

“During the lean times, we didn’t see the investments from the OEMs that we’re seeing today,” Jones said. “Between now and 2025, there’s a predicted $300 billion worth of investment in EV platforms that’s coming out of the automotive manufacturers, and that’s astounding from where we once were.”

DEBUT: 2020 Auto e-tron GT arrives in two flavors

Demand for EVs is increasing as cars like Tesla and the new Audi e-tron break stigmas around EVs being less aesthetically pleasing and providing less utility. Jones said there are about 100 new EVs coming to market by 2025, so he’s expecting to see increased revenue toward the second half of this year and then onward on a large trajectory.

Furthermore, growing concerns over environmental pollution are leading states like California and Massachusetts to ban the sale of ICE vehicles by 2035, and more states are sure to follow. The Biden presidency will also give a major boost to the industry. The president’s economic stimulus-meets climate action agenda aims to spend $1.7 billion over the next decade to electrify government fleets, and Biden has pledged to create 500,000 EV charging stations nationwide as part of his “Buy American” executive order that requires the United States Government to, whenever possible, “procure goods, products, materials, and services from sources that will help American businesses compete in strategic industries and help America’s workers thrive.”

Jones said Blink is currently bidding for contracts with the government. To improve its chances, management is making a priority out of bringing more of its manufacturing Stateside. At present, Blink mainly assembles in the US, but like any other charging company, much of its material sourcing and manufacturing is done outside the country.

Blink still has a ways to go until it controls a sizable portion of the market share. The company is investigating ways to further diversify revenue with, for example, a battery assistance scheme that allows high demand markets to use its batteries to offset demand chargers. Blink is also exploring Vehicle-to-Grid (V2G) technology which would allow the company to manage the duty cycle of EVs that are hooked up to its chargers, facilitating the storage and flow of electricity between the car batteries when demand is low (usually at night) and the grid when demand is high.

Jones said Blink also hopes to gain revenue from ancillary elements like its investment into California’s BlueLA, an electric car-sharing scheme. Blink acquired the company last September, replaced all the chargers in its network with new high speed chargers, and added in some new Chevy Bolts to the fleet.

“We’re taking steps to diversify not only in infrastructure, but also in how infrastructure facilitates e-mobility,” said Jones. “When you look at Blink, we are the most flexible company out there. We’re the most vertically integrated and we’re very focused on our owned-and-operated model as the way we derive revenue. We believe that is sustainable today, tomorrow, and in the future.”